Internal Control teams using Operational Controls Management will follow the following process.

- Establish your plan, process, narratives and entity structure

- Model your entity structure to reflect the regions, systems or business units to report on.

- Centralize your library of risks and controls to streamline and harmonize your controls.

- Access pre-built SOX risk and control matrices that align with COSO standards.

- They collaborate with the rest of the company to bring together their processes, narratives, flowcharts, and more (PBCS).

- Perform a risk assessment on controls

- conduct a risk assessment based on industry best practices to focus on controls that will prevent material risks.

- add key attributes and entities to key controls.

- Carry out tests and trials

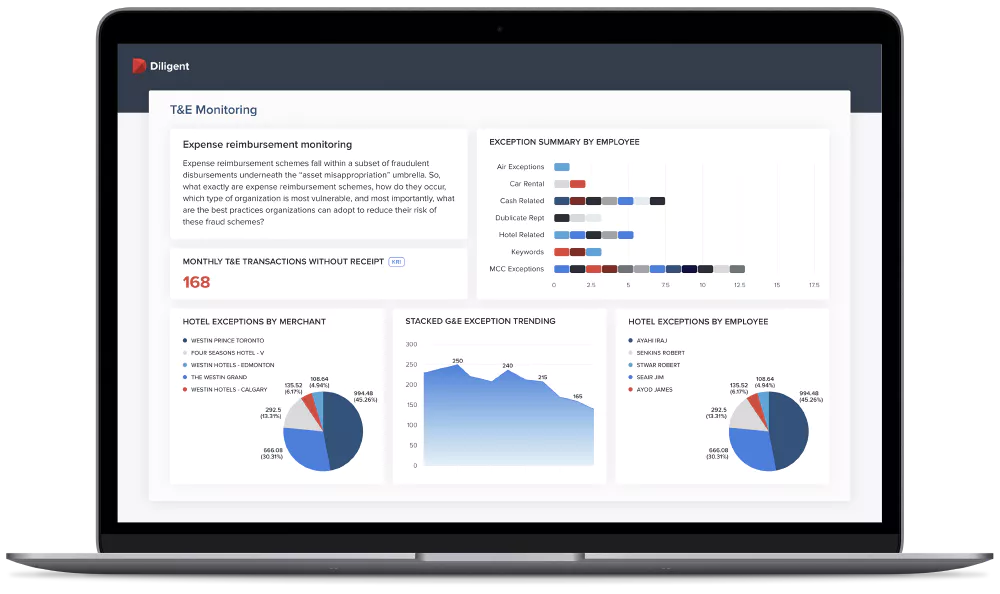

- Engage in front-line self-assessment of control, perform walkthroughs and tests directly within the platform, analyze transaction data in real time to detect leaks.

- Automate testing and real-time monitoring of controls with Robotics.

- Automate workflows, notifications, and task lists to ensure tasks are completed on time.

- Identify deficiencies and remedy them

- Track, remedy and report deficiencies/problems.

- Automate action plans and assign people to follow up.

- Cite evidence directly within the platform.

- Collaborate with process owners when issues or deficiencies are noted.

- Report to executives and get certified

- Use surveys to manage 302 certificates (SOX).

- Create dashboards for notification of the situation and deficiencies of the PMO.

- Effortlessly update stakeholders with one-click reports.